What did not happen in October 2024 (SAND - Part 13)

Let's talk about what did not happen in October 2024, that changed the course of history and led to multiple lawsuits being fought ...

While there are ongoing disputes in both Singapore and Vietnam jurisdictions, there are a lot of things that I could not share publicly. However, there are things that were supposed to happen but did not happen specifically in October 2024 that I could talk about. These "non-events" are beginning of a weird narrative that continues to unravel, revealing a pattern of strategic silence and questionable conduct.

ACRA Accounting and Corporate Regulatory Authority.

🇻🇳 Đọc phiên bản tiếng Việt tại đây 🇻🇳

🔪 What did not happen on 1st October 2024

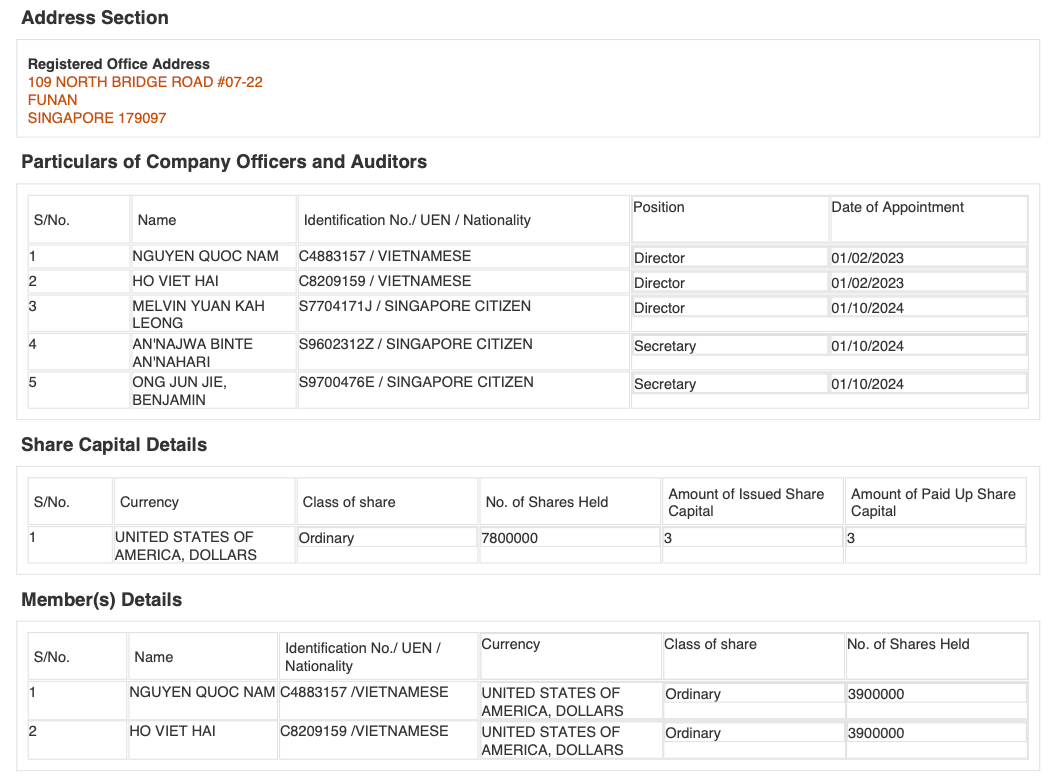

Neither I, Kent, nor my sister, Kim Nguyen, were formally informed or notified of a significant change in directorship at Alterno Pte. Ltd. in Singapore. Instead, a new Singaporean Director, Melvin Yuan Kah Leong, was quietly appointed along with two secretaries. I believe they are linked to histellar.com legal agency based on the emails being used. I do not know, and have never met Melvin.

Even more unsettling, Kim Nguyen, was removed without her knowledge or any formal notification. This lack of transparency persisted, as no formal announcement or email about these changes was ever sent out, even as of July 2025 a year later.

Adding another layer to this perplexing situation, the agreement from the Annual General Meeting (AGM) on August 8, 2024, implied that Touchstone Partners would be the fourth board member, making a majority decision require 3 out of 4 votes, not just 2 out of 3. However, Touchstone remained conspicuously absent from ACRA filings, a fact that remains true even today. This raises a profound question: were the other investors (Radical Fund, Impact Square, Schneider Electric, Glocalinks, and Antler) truly informed about these directorship changes before October 29, 2024, or were they also left in the dark about these quiet maneuvers?

The investment agreements, such as the typical S.A.F.E notes, about certain "Reserved Matters," including changes to the company's capital or board composition, typically require investor approval. Yet, the process seemed to bypass the very people who were supposed to be involved.

📅 What did not happen on 16th Oct 2024:

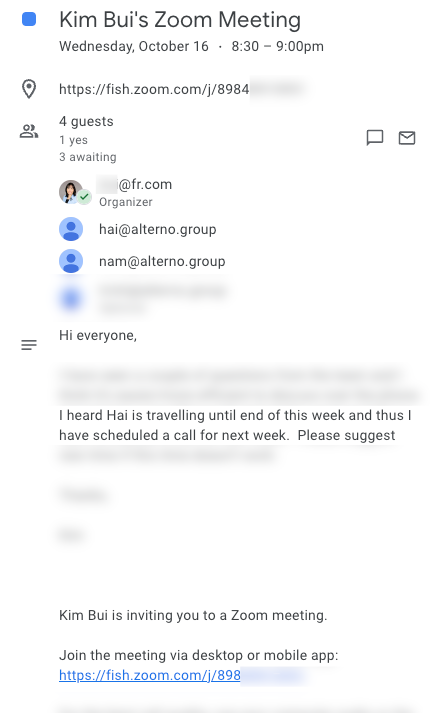

This day, October 16, 2024, became a stark illustration of the deliberate information control being exerted. In the morning Vietnam time, my company email account, [email protected], was forcefully terminated. Later I came to believe that this was to deliberately cut off my access to critical communications about the expected events, isolating me, even to voice out my opinions. My attorney protested this action, but to no avail (ongoing Labour Code case). The very fact that the email address remained active and capable of receiving messages as of June 2025, nearly eight months later, further confirmed my suspicion: it wasn't truly "deleted," but merely restricted from my use. To me, the timing felt like intentional rather than coincidental.

I later discovered a relevant meeting was scheduled for the very same day, October 16, 2024, at 8:30 PM Vietnam time. This meeting was between Kim Bui from fr.com and Hai Ho & Nam Nguyen. FR is the legal agency based in the US, which helped Alterno Singapore in filing the USPTO patent application earlier in April 2024.

I, being one of the named inventors on the patent, was neither invited nor informed about this discussion regarding the USPTO application until the day that I ceased to be a Director/Shareholder. The sheer coincidence of my email cut-off preceding this patent meeting lead to my hypothesis: the Alterno management team intentionally concealed updates about the patent from me. It felt like a deliberate move to ensure I remained in my own bubble.

This "strategic silence" about such a powerful intellectual property asset defies all business logic and is a clear indication that vital information was deliberately withheld, impacting the company's valuation, company's image, my personal circumstances and share transfer negotiations. This is simply unacceptable at the very least.

💰 What were not shared regarding critical financial information

Despite my continuous requests throughout August and September 2024 within my rights as both employee and shareholder of both companies, vital details that were foundational to determining the offer package for my share transfer were never shared.

I had specifically asked for typical materials like raw financial ledger data, cash flow projections, and up-to-date company updates. I discovered the presence of file named Financials and KPIs template - Hardware 20241016 (Sept'24).xlsx that was never sent to me and I have not seen its content. You can probably guess what it should contain. Most of the responses I got asking for information were stonewalled or ignored. I didn't think I had enough information to properly evaluate a share buyback offer, I made that clear to the board.

💬 What did not happen on 24th October 2024

On October 24, 2024, despite my role and involvement, I was neither informed nor invited to a meeting with one of our early investors: Impact Square (Korean). This was again a deliberate exclusion from discussions that held the keys to understanding the company's true financial health and future trajectory at that time.

While I cannot confirm the details of this supposedly confidential investor meeting, I suspect that during this meeting, certain upcoming term sheets and investment opportunities and financial status were discussed with ISQ representatives. I also have reasons to believe that the financial data file mentioned above, were briefed to ISQ.

Can you imagine the importance of this? Had I been privy to them, it would have drastically altered my decisions in the days that followed.

🤔 What did not happen on 29th October 2024

On that pivotal day, as I signed the Singapore Share Transfer Contract, I was deliberately kept in the dark about a monumental achievement: the official approval of the USPTO patent for the Sand Battery technology. The timing itself is eerily precise, almost too coincidental: the patent was approved in the US on the exact same day I signed the contract, just hours later due to the time zone difference.

This deliberate withholding of information becomes even more glaring when considering the events preceding it. Just 13 days prior. This began to show a clear sequence of calculated moves that severed my primary lifeline to critical company information and communications, including any updates on the patent application status.

Alterno has made no public announcement, and the patent doesn't appear on their website or in their press releases. This "strategic silence" speaks a lot about what they perhaps did not want me to know when I was forced to weight decisions about my future with the company. This is asymmetric information warfare in action.

✍🏻 What did not happen after the Share Transfer Contract was signed

I signed the Singapore Share Transfer Contract under immense duress. This was a painful decision, made amidst a complete breakdown of trust and communication, and following Alterno Vietnam's termination decision against me on September 17, 2024, based on claims I maintain were false.

The terms of the share transfer contract also included specific post-transfer procedures, particularly regarding the updating of ACRA details in Singapore. The agreement stated that I was supposed to assist Alterno Singapore in removing my name and my sister’s name (who was also a Singaporean Director) from ACRA only after the second installment had been made.

Yet, here's what truly did not happen:

- I was not informed of a new director's appointment. A Singaporean Director, Melvin Yuan Kah Leong, was appointed on October 1, 2024, without my knowledge or my sister’s knowledge. This occurred before the share transfer was even signed.

- My sister, Kim Nguyen, was not formally notified of her removal as a director. ACRA documents suggested that as of 29th Oct 2024, she was no longer a Director of Alterno Singapore Pte Ltd.

- Neither my sister nor I received any notification or request for signature for ACRA matters after the second payment end November 2024. Until now July 2025.

So many questions that remain unanswered:

- How was the Alterno Singapore management team able to remove my name and my sister’s name from the ACRA registration without our consent or signatures?

- When exactly did I cease to be a Director of Alterno Singapore? When did my sister cease to be one?

This apparent disregard for due process and the company’s own constitution reinforces the pattern of secrecy and unauthorized actions that defined this period.

⁉️ What did the Investors know and When did they know about it?

This is the fundamental question to establish the involvement of each VC institutes. Why did those who funded Alterno, people who were privy to discussions and had a vested interest in the company's integrity, remain conspicuously quiet during a period rife with what I believe was deliberate misinformation and manipulation?

Here are a bunch more of questions that I'm still seeking the answers for:

- Why were Touchstone Partners not added as part of ACRA before October 1, 2024? What happened after August 8, 2024? During this period, with Hai Ho and Nam Nguyen in complete control of the legal process, why didn't they follow the terms of the AGM?

- Were Touchstone Partners or any of the investors informed about the change of director on October 1, 2024? What did they do about it when they came to know?

- When did any of the investors come to be aware about the updates on the USPTO patent? What were said before and after October 29, 2024?

- What did the investors know that kept them silent for a long time?

- Why did the investors rarely promoted Alterno since then (based on LinkedIn and PR activities from Oct 2024 to now), except Antler and recent investors?

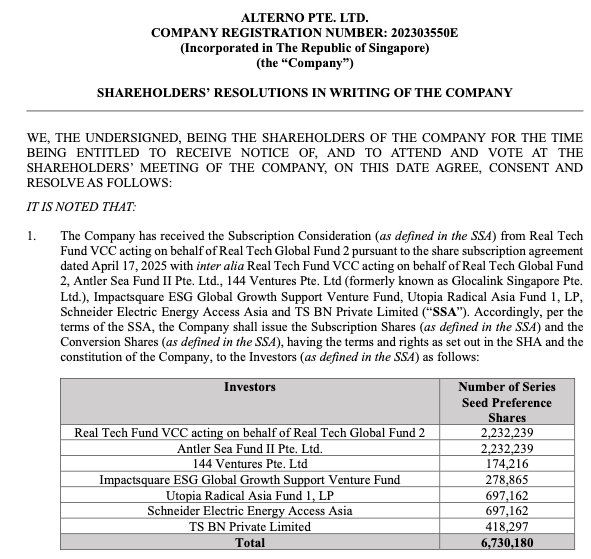

- What did UntroD (Real Tech VCC) and ADB Ventures (144 Ventures) learn about during their Due Diligence process, before leading the 1M investment round on 17th April 2025? Were they informed for the court summon on 15th April 2025? Why were they agreed to pass DD given this fact?

- Why were there no progress made since the investment round announcement 2 months ago 13th May 2025?

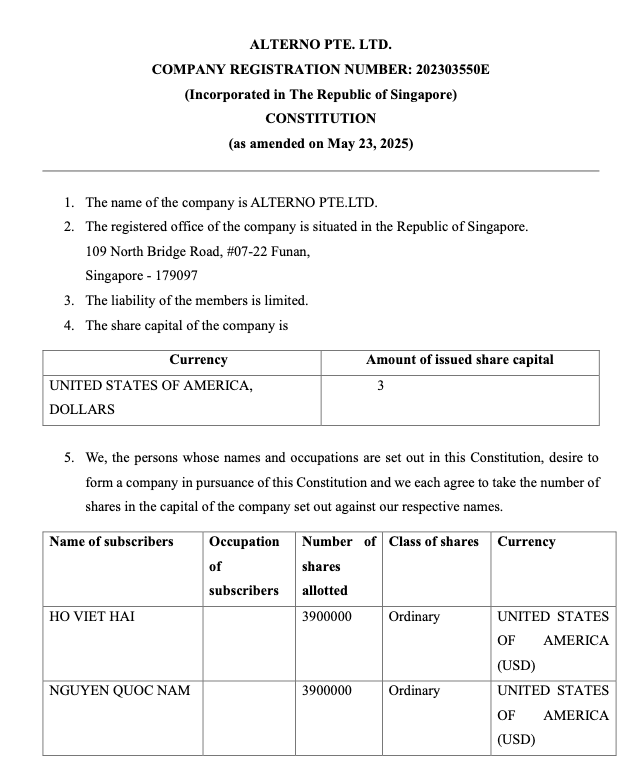

- The company constitution was updated on 23rd May 2025? What changed and why? (I'll compare the changes and share in another chapter).

What do you think happened to the Venture Capitalists given what you've heard around?

To sum it up

As I reflect on these events, it becomes clear that these were, in fact, precisely orchestrated actions designed to achieve specific outcomes. They revealed a disturbing pattern of stonewalling, recklessness behaviors and what I continue to believe are unethical.

My life story, continues to unfold, and I will bring out the truth, no matter how complex or unsettling... 🔪🔪🔪

The best is yet to come.